Trolley Payouts: Strategic Infrastructure for Global Contractor and Marketplace Payments

The Infrastructure Behind Modern Platform Payments

As platform-based business models expand, payment distribution becomes a structural challenge rather than a simple accounting task.

Companies operating globally must manage:

- High payout volume

- Cross-border compliance

- Multiple currencies

- Tax documentation

- Audit transparency

Instead of relying on fragmented tools, many platforms implement centralized systems like trolley payouts to coordinate payment execution and documentation in one workflow.

About the Company Behind Trolley Payouts

4

Trolley is a financial technology provider specializing in automated payout systems for digital businesses.

The company focuses on building backend infrastructure that allows organizations to send large volumes of payments efficiently while maintaining structured oversight.

Core Architecture of Trolley Payouts

Trolley payouts combine several operational layers into a unified system.

1. Payee Data Collection Layer

Recipients submit required information through a secure interface. This may include:

- Bank routing details

- International banking information

- Required tax documentation

Validation helps reduce transfer failures.

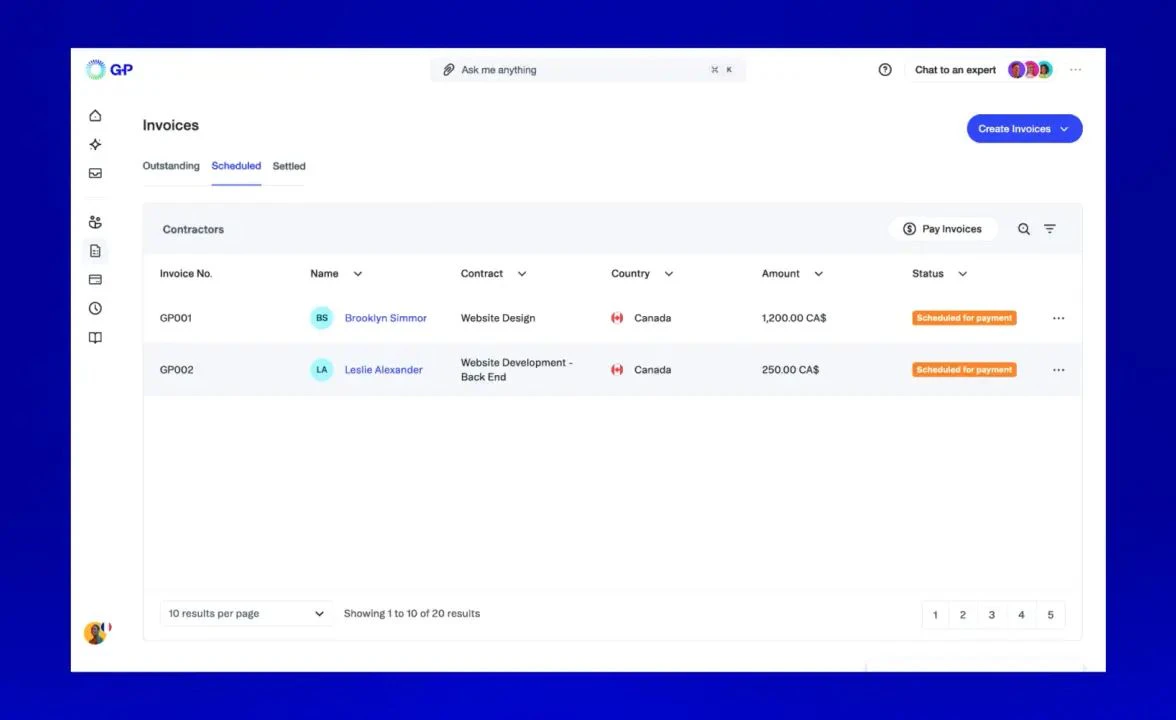

2. Compliance and Documentation Management

Global payout programs must track documentation requirements. Trolley payouts centralize digital tax form handling to simplify year-end reporting.

This layer reduces manual reconciliation during reporting cycles.

3. Payment Processing Engine

The payout engine supports:

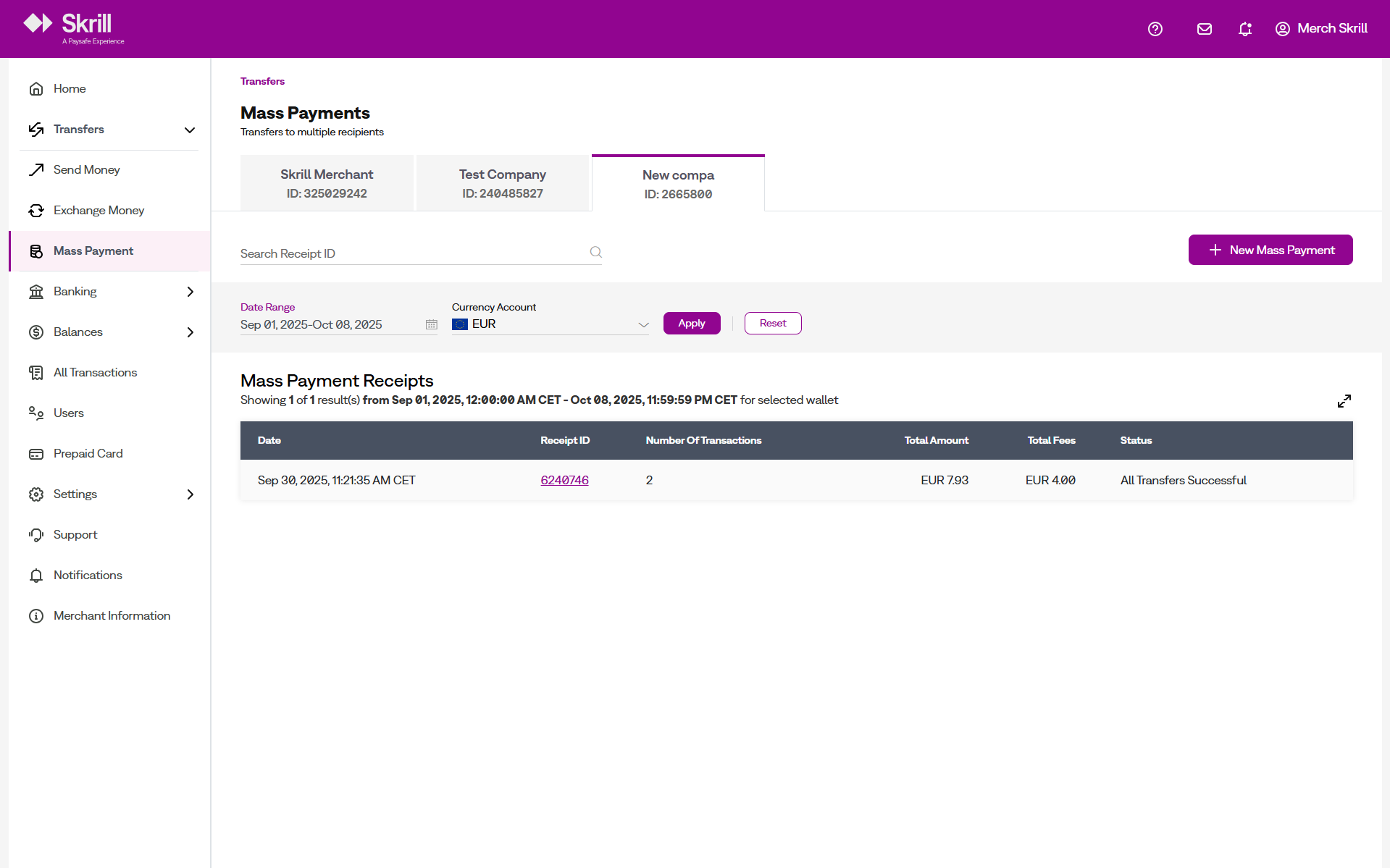

- Bulk payment batches

- Recurring payout schedules

- API-triggered disbursements

- Approval-based release workflows

Automation ensures consistent payout timing.

4. Monitoring & Audit Layer

Operational visibility includes:

- Batch summaries

- Payment status updates

- Exception reporting

Finance teams maintain control while minimizing repetitive manual tasks.

Industries That Rely on Trolley Payouts

Trolley payouts are particularly relevant in:

Marketplace Platforms

Seller payouts require scalable infrastructure across multiple regions.

Creator Monetization Ecosystems

Revenue-share distribution to thousands of creators demands automation.

Affiliate & Referral Programs

Commission payouts benefit from structured tracking.

SaaS Revenue Partnerships

Recurring partner compensation requires predictable disbursement cycles.

Business Benefits of Implementing Trolley Payouts

Scalable Operations

Automated disbursement reduces administrative scaling costs.

Risk Mitigation

Validation and workflow controls reduce duplicate or failed transfers.

Global Expansion Readiness

Cross-border payout capability supports international growth strategies.

Centralized Documentation

Digital tax workflows reduce reporting friction.

Manual Processing vs. Centralized Payout Infrastructure

| Operational Function | Manual Method | Trolley Payouts |

|---|---|---|

| Data validation | Spreadsheet checks | Automated |

| Batch processing | Manual bank uploads | Integrated |

| Compliance tracking | Separate systems | Centralized |

| International reach | Multiple banks | Unified |

| Audit trail | Limited | Structured |

As payout volume increases, centralized infrastructure becomes operationally advantageous.

Security & Governance Considerations

Modern payout systems incorporate:

- Encrypted data transfer

- Role-based user access

- Structured activity logs

Organizations should conduct internal compliance reviews before integrating any third-party financial system.

Why Interest in “Trolley Payouts” Continues to Grow

Search behavior indicates increasing demand for:

- Global contractor payment solutions

- Mass payout software

- Automated disbursement platforms

- Cross-border compliance tools

The growth of remote work and digital platform models drives sustained interest in payout infrastructure solutions.

Frequently Asked Questions

Do trolley payouts support high-volume platforms?

They are commonly used by platforms distributing large numbers of payments per cycle.

Is API integration available?

API access allows integration into internal dashboards and operational systems.

Are payout schedules customizable?

Yes, businesses can configure recurring or event-based payout cycles depending on operational requirements.

Strategic Outlook

In the evolving digital economy, payment distribution is no longer a back-office function — it is a strategic infrastructure decision.

Trolley payouts provide:

- Automation

- Documentation management

- Operational transparency

- Global scalability

As platform ecosystems expand internationally, structured payout infrastructure becomes foundational rather than optional.