Trolley Payouts Explained: Scalable Infrastructure for Global Payment Automation

Why Businesses Are Moving Toward Automated Payout Systems

As companies expand globally, managing outgoing payments becomes more complex. Marketplaces, SaaS companies, and creator platforms often need to distribute funds to thousands of recipients across different countries.

Manual processing creates operational bottlenecks.

Trolley payouts are designed to centralize and automate this process — helping businesses handle disbursements at scale without increasing administrative overhead.

What Is Trolley and What Does It Provide?

4

Trolley provides payout infrastructure that integrates payment automation with tax documentation workflows.

Instead of operating separate systems for onboarding, compliance, and payment execution, companies can use a single infrastructure layer.

Core capabilities include:

- Global mass disbursement

- Payee onboarding workflows

- Tax form collection

- Payment status tracking

- API-driven integrations

How Trolley Payouts Fit Into Modern Digital Platforms

Modern platforms typically operate within one of these models:

- Two-sided marketplaces

- Affiliate networks

- Creator monetization platforms

- SaaS revenue-sharing programs

All of these require predictable and structured payout mechanisms.

Trolley payouts integrate directly into platform workflows, enabling:

- Automated payout triggers

- Scheduled batch processing

- Centralized financial reporting

Step-by-Step: How Trolley Payouts Work

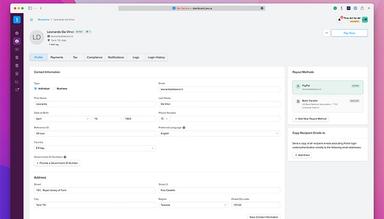

1. Payee Registration

Recipients securely submit required data, including:

- Payment details

- Tax documentation

- Contact information

Automated validation reduces failed transfers.

2. Compliance Layer

Before funds are distributed, companies can verify that required documentation is completed and stored correctly.

This minimizes regulatory exposure in multi-country operations.

3. Payment Processing

Businesses can:

- Run bulk payout cycles

- Automate recurring distributions

- Track payment status in real time

4. Reporting & Oversight

Finance teams gain visibility into:

- Payment batches

- Settlement status

- Historical payout records

Key Advantages of Trolley Payouts

Operational Scalability

As transaction volumes grow, automation becomes critical. Trolley payouts allow businesses to increase payout volume without proportionally increasing staff.

Reduced Payment Errors

Built-in validation systems help reduce:

- Incorrect routing details

- Duplicate payees

- Manual input mistakes

Global Reach

International payments require local knowledge and banking connections. Centralized payout systems simplify global expansion.

Better Payee Experience

Recipients can:

- Select preferred payout methods

- Track payment history

- Manage documentation securely

Industries That Benefit Most

Trolley payouts are commonly used in:

Creator Economy Platforms

Content monetization platforms that pay creators monthly need reliable automation.

Digital Marketplaces

Online marketplaces with global sellers rely on scalable payout infrastructure.

Affiliate Marketing Networks

Commission-based programs require accurate mass disbursement tools.

SaaS Ecosystems

Software platforms offering partner revenue shares benefit from centralized payout control.

Security and Risk Management

Financial operations require strict security standards.

Trolley payouts incorporate:

- Data encryption protocols

- Structured user access roles

- Payment verification procedures

Businesses should always conduct internal due diligence when integrating third-party financial infrastructure.

Why Search Interest in “Trolley Payouts” Is Increasing

Several market trends drive growth in this search term:

- Expansion of remote work

- Rise of global freelancers

- Growth of creator monetization

- Increased compliance scrutiny

Companies are actively researching structured payout systems that combine automation and compliance.

Frequently Asked Questions

Are Trolley payouts only for large enterprises?

While often used by scaling platforms, mid-sized companies can also integrate payout automation depending on volume and infrastructure needs.

Can Trolley payouts support recurring payment models?

Yes. Businesses can configure recurring payout cycles based on internal financial rules.

Do Trolley payouts replace traditional banking?

No. They act as an infrastructure layer that connects to banking systems while automating operational workflows.

Final Perspective

In 2026, payment infrastructure is no longer a back-office function — it is a strategic asset.

Companies that operate globally must manage:

- Compliance complexity

- Cross-border disbursements

- Recipient onboarding

- Financial reporting

Trolley payouts provide a structured solution to address these operational challenges.

For platforms focused on scale, automation, and risk reduction, payout infrastructure becomes part of long-term growth strategy.