Trolley Payouts: A Modern Framework for Global Mass Payment Automation

Why Global Platforms Need Structured Payout Infrastructure

Digital businesses increasingly operate across borders. Marketplaces, SaaS ecosystems, affiliate programs, and creator platforms distribute funds to recipients in multiple countries.

As payout volume grows, companies must manage:

- Cross-border banking rules

- Tax documentation requirements

- Payment validation

- Batch scheduling

- Audit transparency

Without structured automation, these processes become operational bottlenecks.

This is where trolley payouts fit into the picture — as infrastructure designed to centralize and automate large-scale disbursement workflows.

What Is Trolley?

4

Trolley is a financial technology company focused on automated payout solutions for digital platforms.

Rather than operating as a consumer-facing payment app, Trolley provides backend infrastructure that helps businesses manage outgoing payments, compliance documentation, and payee onboarding through a centralized system.

Core Components of Trolley Payouts

Modern payout systems require multiple integrated layers. Trolley payouts combine these components into a unified framework.

1. Payee Onboarding

Recipients securely submit:

- Banking details

- Required tax forms

- Contact information

Built-in validation helps reduce failed or misdirected transfers.

2. Compliance Management

For platforms operating internationally, documentation is critical. Trolley supports digital tax form collection and centralized record management, helping businesses maintain organized compliance workflows.

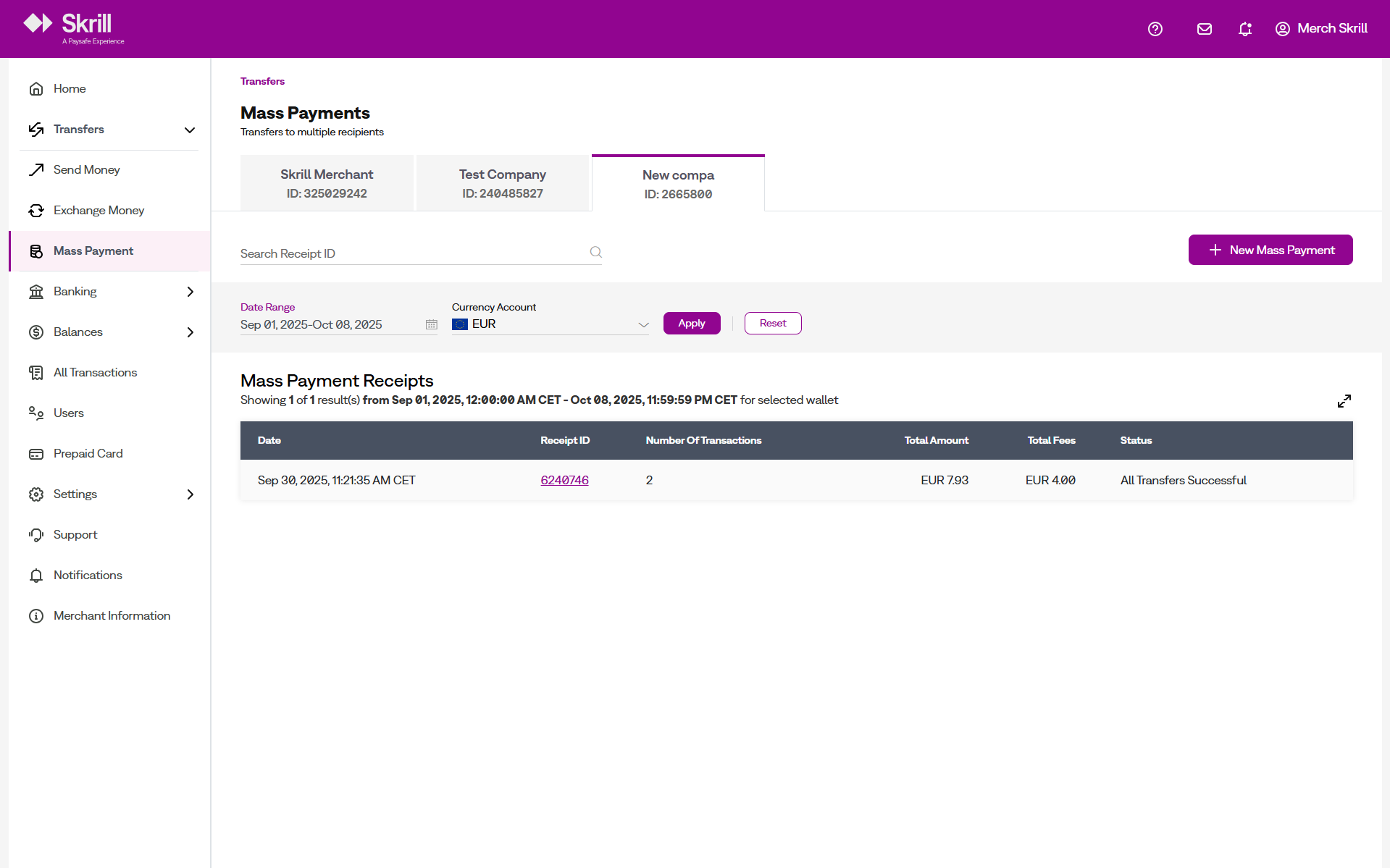

3. Mass Disbursement Engine

Companies can:

- Schedule recurring payout cycles

- Process batch payments

- Trigger disbursements via API

- Configure internal approval steps

Automation reduces manual intervention and improves operational consistency.

4. Reporting & Monitoring

Finance teams gain access to:

- Batch summaries

- Payment status tracking

- Historical transaction records

- Exception alerts

This improves transparency and audit readiness.

Who Typically Uses Trolley Payouts?

Trolley payouts are commonly implemented by:

Online Marketplaces

Platforms paying sellers across multiple regions.

Creator Monetization Platforms

Services distributing revenue shares to content creators.

Affiliate & Referral Networks

Programs paying commissions at scale.

SaaS Partner Ecosystems

Software companies managing recurring partner payouts.

Operational Advantages of Trolley Payouts

Scalability

Manual bank uploads and spreadsheet-driven systems do not scale efficiently. Automated payout infrastructure supports growing transaction volume without linear staffing increases.

Reduced Error Risk

Data validation tools help minimize:

- Incorrect banking information

- Duplicate payees

- Failed transactions

Centralized Documentation

Digital tax form management reduces year-end reconciliation complexity.

Global Expansion Support

Structured payout infrastructure simplifies cross-border operations.

Traditional Processing vs. Automated Payout Systems

| Operational Area | Manual Process | Trolley Payouts |

|---|---|---|

| Bank data checks | Manual review | Automated validation |

| Mass payout execution | Spreadsheet uploads | Integrated batching |

| Tax documentation | Separate tools | Embedded workflows |

| International coverage | Fragmented | Centralized |

| API integration | Limited | Available |

Automation becomes increasingly important as platforms scale internationally.

Security Considerations

Handling financial data requires strict safeguards. Modern payout infrastructure typically includes:

- Encrypted data transmission

- Role-based access controls

- Structured audit logging

Organizations should conduct internal compliance reviews before implementing any third-party financial system.

Why “Trolley Payouts” Is a Growing Search Term

Interest in payout automation continues to rise due to:

- Expansion of remote and gig work

- Growth of cross-border marketplaces

- Increasing regulatory reporting requirements

- Rapid scaling of creator monetization models

As digital ecosystems mature, structured payout infrastructure becomes a strategic priority.

Frequently Asked Questions

Are trolley payouts designed only for enterprise platforms?

While often adopted by scaling or high-volume platforms, suitability depends on business model and payout complexity.

Do trolley payouts replace banking systems?

No. They operate as an automation layer that integrates with banking infrastructure.

Can payout cycles be customized?

Yes. Businesses can configure payout schedules based on operational needs and internal approval workflows.

Final Perspective

In today’s platform economy, outgoing payments are not just administrative transactions — they are part of operational reliability and user trust.

Trolley payouts provide a structured framework for:

- Automating global disbursements

- Managing tax documentation

- Reducing operational friction

- Supporting scalable growth

For platforms distributing funds at scale, payout infrastructure is increasingly viewed as a core architectural component rather than an optional add-on.