Trolley Payouts Guide: Automation, Compliance, and Global Payment Scalability

The Evolution of Global Payout Management

Digital businesses are increasingly international by default. Platforms serving contractors, sellers, creators, and partners must manage outgoing payments across jurisdictions.

This introduces operational complexity:

- Currency differences

- Regulatory documentation

- Bank validation

- Fraud controls

- Batch processing

Trolley payouts are designed to simplify this ecosystem by combining automation and compliance into a unified system.

Company Overview

4

Trolley provides infrastructure for platforms that need to send high volumes of payments while maintaining structured oversight.

Rather than operating as a consumer wallet, Trolley focuses on B2B payout automation.

Core Pillars of Trolley Payouts

1. Automated Payee Onboarding

Recipients securely enter their:

- Payment details

- Tax documentation

- Personal or business information

Built-in validation reduces errors before payments are processed.

2. Payment Method Flexibility

Depending on region and integration, platforms may support:

- Local bank transfers

- ACH transfers (U.S.)

- International wire payments

This flexibility supports cross-border expansion.

3. Batch & Scheduled Disbursements

Companies can configure:

- Recurring payout cycles

- Milestone-triggered payments

- Manual approval checkpoints

Automation helps maintain predictable payout timing.

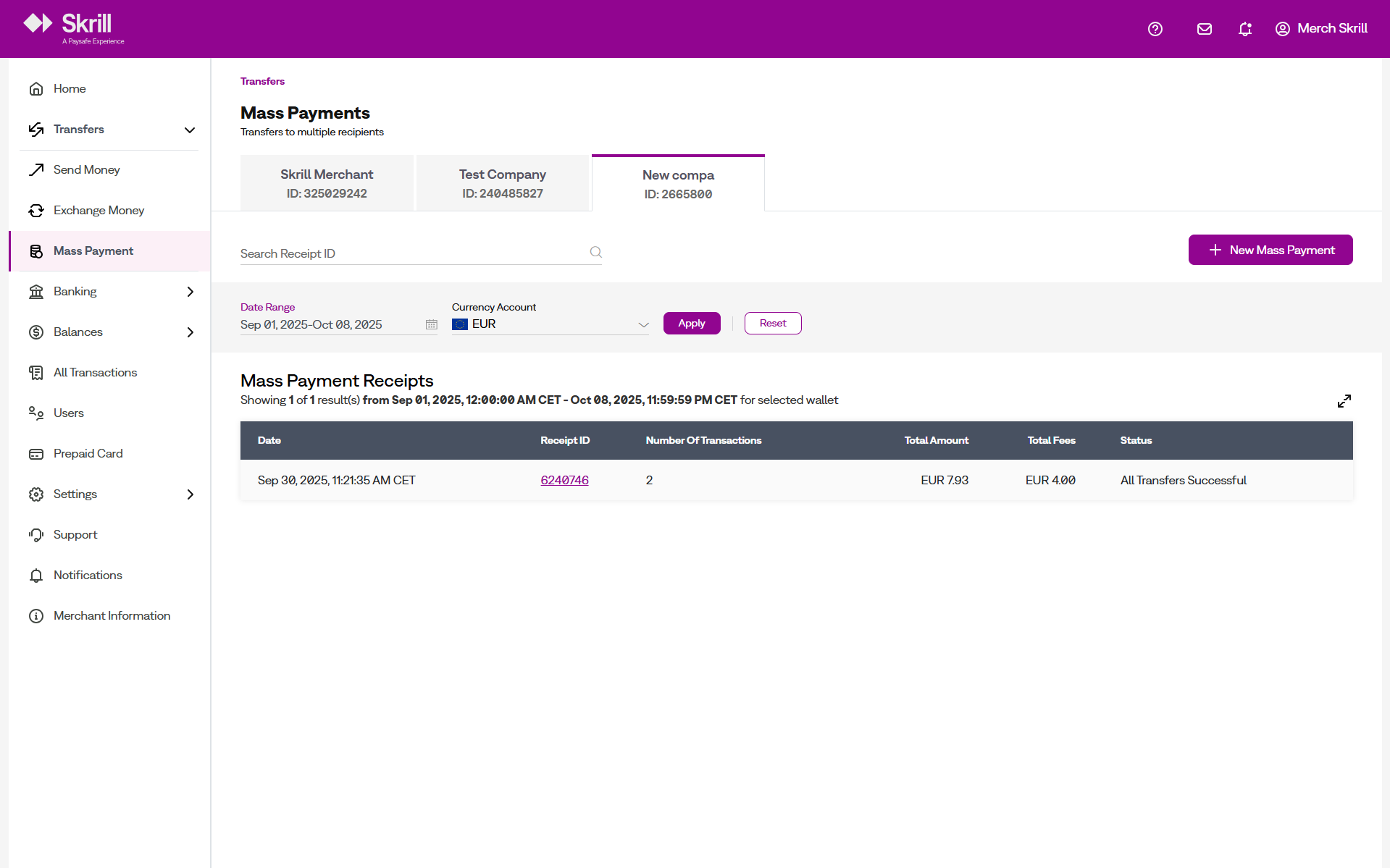

4. Reporting and Visibility

Finance teams gain centralized access to:

- Transaction history

- Payment batch logs

- Exception handling workflows

This improves transparency and audit readiness.

Why Platforms Adopt Trolley Payouts

Scalability

Manual payment processes do not scale efficiently beyond early growth stages.

Compliance Alignment

Digital tax form collection supports organized documentation management.

Operational Control

Role-based permissions help maintain oversight without bottlenecks.

Reduced Payment Failures

Automated validation reduces returned or misdirected transfers.

Industries That Commonly Implement Trolley Payouts

Trolley payouts are typically relevant for:

- Creator monetization platforms

- Global marketplaces

- Affiliate commission networks

- SaaS partner ecosystems

- Gig economy applications

These models require consistent, large-scale disbursement processes.

Comparing Traditional Systems to Payout Infrastructure

| Operational Layer | Traditional Process | Trolley Payouts |

|---|---|---|

| Bank data checks | Manual | Automated |

| Mass payout cycles | Spreadsheet-driven | Integrated |

| Tax form management | Separate system | Embedded |

| International expansion | Complex | Structured |

| API connectivity | Limited | Available |

Automation reduces administrative exposure and operational fragmentation.

Security Considerations

Handling payout data requires robust controls. Modern payout platforms typically incorporate:

- Encrypted transmission standards

- Access management layers

- Audit trail logging

Organizations should independently verify security alignment with internal policies before deployment.

Why Search Interest in “Trolley Payouts” Is Growing

Several macro trends contribute:

- Remote-first business models

- Cross-border freelancing

- Platform-based economies

- Heightened regulatory scrutiny

As these trends accelerate, structured payout infrastructure becomes increasingly important.

Frequently Asked Questions

Is Trolley payouts suitable for startups?

Depending on transaction volume and operational complexity, some growth-stage companies may benefit from early automation.

Can Trolley payouts integrate with internal systems?

API-based integration supports connection with internal dashboards and financial systems.

Does Trolley replace internal finance teams?

No. It supports automation while finance teams maintain strategic oversight.

Strategic Conclusion

Payout automation is no longer an optional back-office tool — it is part of core platform architecture.

Trolley payouts help businesses:

- Streamline global disbursements

- Improve documentation management

- Reduce operational friction

- Support international scaling

As digital ecosystems continue to expand, structured payout infrastructure will remain a foundational component of sustainable growth.